When I started in the rental business back in 2002, I used to collect rent in person at the door. I quickly tired of making multiple trips to my properties trying to catch tenants at home with the rent money. My next step was to invoice the tenants by mail each month. Every month I would mail a Quickbooks invoice to each of my tenants. I asked them to pay with checks or money orders sent to me by mail. This was moderately successful. The delay of the mail service and waiting for checks to clear slowed down the process too much. Not to mention the risk of taking bad checks. As we grew to have over a dozen units we knew we needed a better system. We hired a property manager who lived close to most of our units. That worked well for a while but we found it was too expensive to pay someone to collect rent and it didn't solve the problem of chasing rent. We finally decided we needed to shift the burden of rent collection from us to the tenant. Instead of chasing the tenant to collect rent, we needed the tenant to deliver the rent to us.

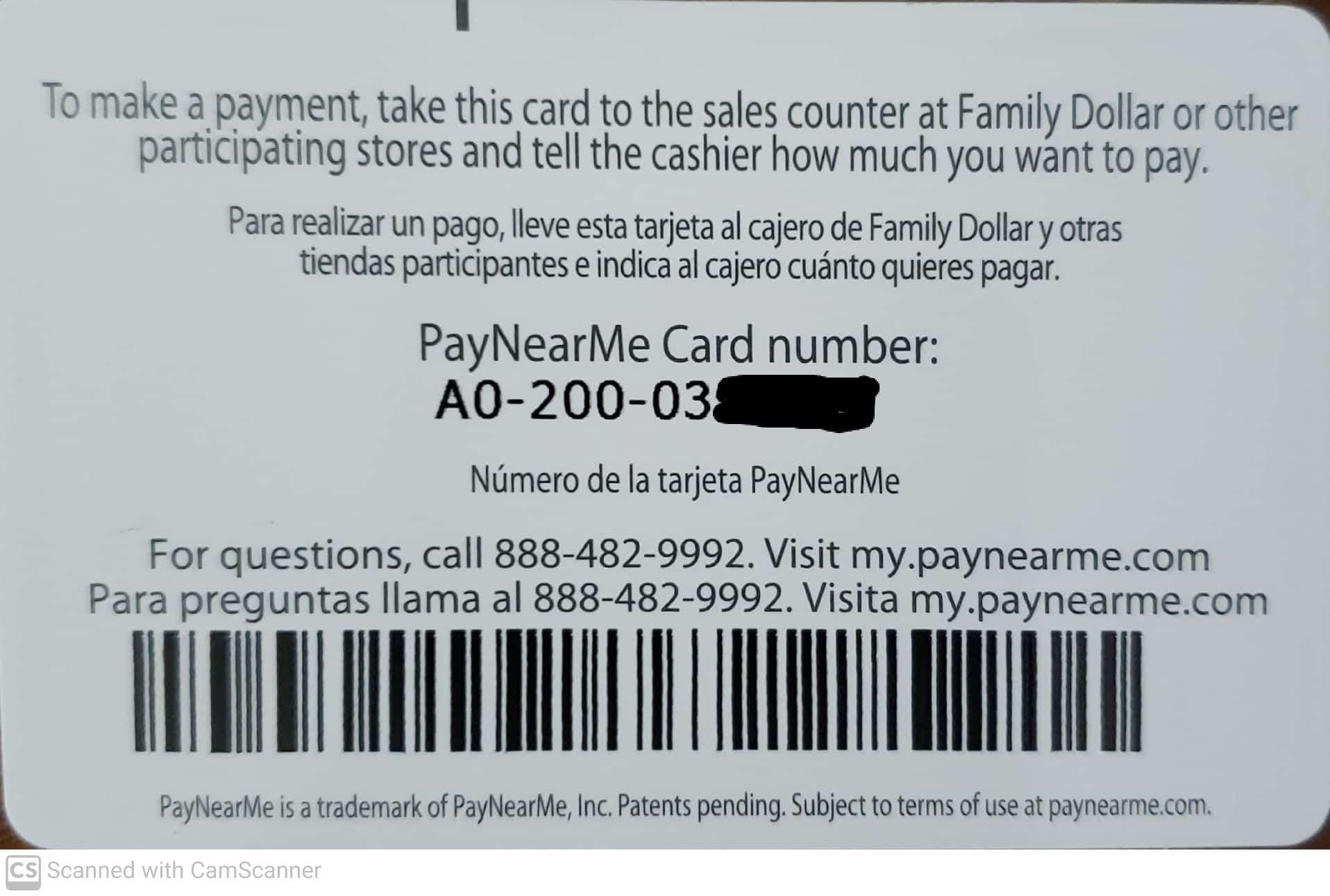

These days the explosion of electronic payment systems on the internet has made things much easier. Several years ago, we began looking at electronic payment (e-pay) systems, and there are dozens to choose from but most require the tenant to have credit or debit cards and/or a bank account. This was problematic for us, as many of our tenants are lower-income and do not have credit/debit cards or bank accounts. Many of the e-pay systems have monthly service fees and/or transaction fees and some require a minimum number of units (doors) that you manage or own before they will even open an account. One major company I spoke with requires 100 doors before they would sign you up. After some searching, I finally found PayNearMe, a relatively new company at the time, that had a cash-only payment system. PayNearMe.com has a unique system that allows you to collect your rent using local retail establishments like CVS Pharmacy, 7-Eleven, and Family Dollar. Using their web-based interface, you simply add the tenant to the system then give the tenant a card with a barcode number on it.

On the first of each month, the tenant then takes their cash rent payment with their PayNearMe Card to the retailer. They give the cash and card to the cashier. The cashier scans the card’s barcode into their point-of-sale (POS) system and receives the cash payment, then gives the tenant a receipt. The system immediately notifies us by text and/or email when a payment has been made, giving us all the pertinent information like name, address, and the amount paid by tenant. There is a $3.99 processing fee that is paid by the tenant. Surprisingly our tenants had no problem paying the fee because they were already paying for multiple money orders, envelopes, and stamps. Most money order companies have limits on how much the maximum amount can be, usually around $200. So if your rent is $600 this means you need to buy three $200 money orders. Another advantage to PayNearMe is these retailers are open 7 days a week, giving tenants more convenient and accommodating hours than most banks.

I really liked the PayNearMe system, but after about a year of using PayNearMe, Family Dollar, which has many locations in our area, stopped accepting rental payments for PayNearMe. Family Dollar was very convenient for our tenants because they had one or more of their locations within a mile of all of our properties. At that time, PayNearMe only had two other partner retailers remaining, they were ACE Cash Advance and 7-Eleven. Unfortunately, we do not have any ACE Cash Advance or 7-Eleven locations here in my town. This left with no retailers in our area to accept our rent payments, so we were forced us to frantically try to find an alternative cash payment solution. (Note: PayNearMe has since signed CVS Pharmacy, which we do have here locally, as a retail cash payment partner.)

We decided to try having our tenants deposit cash payments directly into our bank account. For our business accounts, we were using a small credit union with only a few locations, but none of these locations were close to our rental units. We decided to look for a different financial institution, one with more locations closer to our properties. We ended up going with a larger credit union. We told them we wanted to allow our tenants to be able to make deposits directly into our account. They said they could help us set that up. It hasn’t been a perfect system but it works pretty well. The biggest problem seems to be getting the name or address on the deposit notes in the computer. If the tenant gives the teller their name they are supposed to make a note in the system to let us know who made the deposit. Whether it be the tenant’s failure to give their info or the teller’s failure to record the info, sometimes this doesn’t happen. Which can make it difficult for us to figure out who paid. To alleviate this problem, I also have asked the tenants to text me when they complete their deposit transactions, but many times they forget to do so.

More recently, we have allowed our tenants who have bank accounts to use Venmo to send us the rent. Venmo is a person to person payment app that you download to your smartphone. Venmo has been around since 2009 but really took off a few years ago after Paypal bought them. Venmo has worked well and there are no fees for us or the tenant. Venmo will also notify you when a payment is made and it will tell you who is making the payment. The only drawback is the delay of funds because you have to transfer the money out of Venmo to your account which usually takes a business day or two unless your willing to pay a fee for faster transfers.

Going forward we want to move our tenants more towards electronic payments. While it has been slower with the lower-income tenants, we have made some progress. More and more of our tenants now have the required smartphones, bank cards, and/or bank accounts needed to make this possible.

There are dozens of e-payment options out there. We use Buildium as our property management software. It is a web-based subscription service and it has the ability to integrate with PayNearMe and will allow you to accept EFT and credit card payments for a fee. There are other web-based services like Cozy and Zillow Rental Manager which both have rent collection features. If you are not already using one of these services, I suggest investing some time in researching and choosing one of these solutions to help you streamline your rent collection process. It will make your life much easier and less stressful!