I recently purchased a new 2019 Chevrolet Z71 Silverado truck. This truck had an MSRP of $53,410, but this truck will have a net cost of $0 to me. Because I converted my cash into real estate investments that now make my truck payments.

My Truck is a Better Deal Than a $78 Tesla!

Graham Stephan, a fellow YouTuber, recently did a video on how he got his $40,000 Tesla Model 3 for $78 per month after rebates, tax incentives for electric cars and tax deductions. That video got me to thinking about a couple of things. First off I didn’t realize my new truck cost more than a new Telsa and secondly, I had used a different technique, to reach a similar result, when I bought my truck.

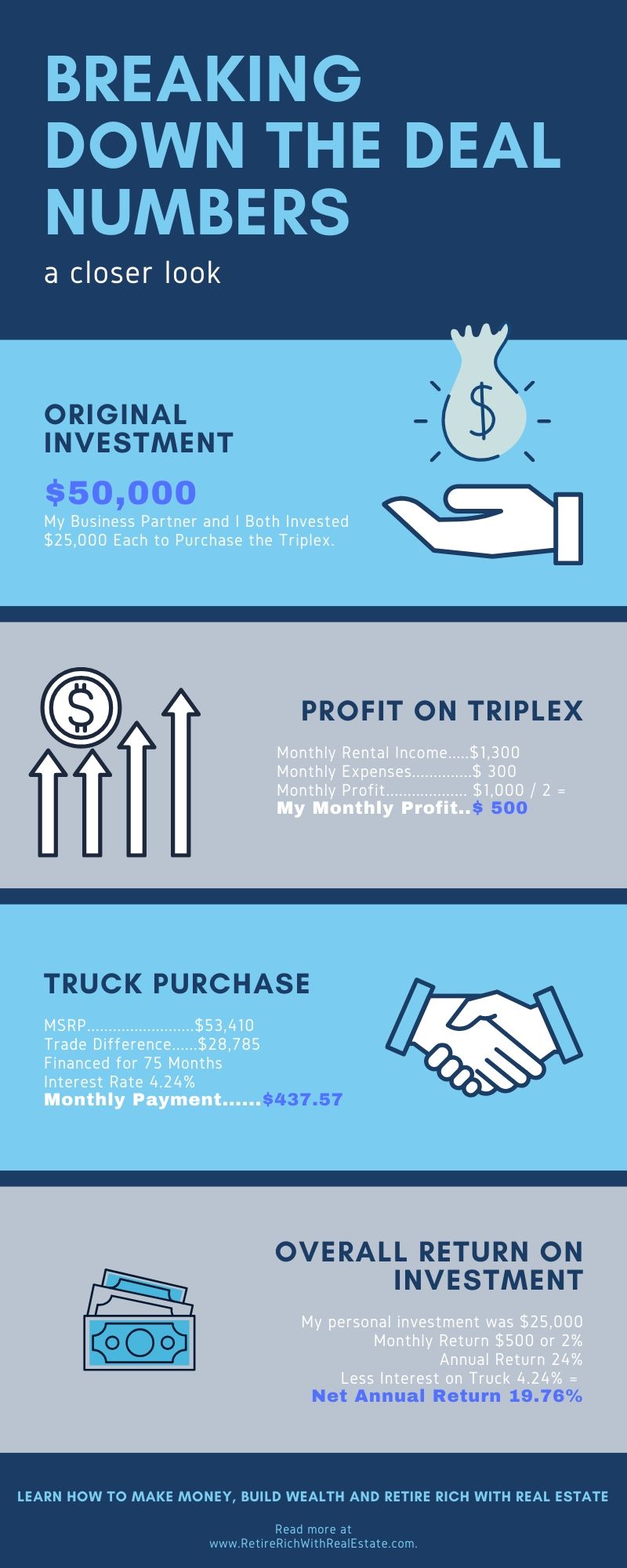

Here’s what I did. A few months ago, I traded in my 2016 Chevrolet Truck in on a new one. I could have paid cash for the difference of $28,785.23, but the interest rates on vehicles are so low right now it doesn’t make sense not to finance. I can make more with my money than they are charging me in interest on the loan.

The same month I bought the truck, I took the cash I did not spend on the truck and invested it in real estate. My business partner and I bought a triplex rental property for $43,000 dollars. It was a great deal, even though the property needed some minor renovations (a little over $6k) and two of the units were vacant. The owner was an older gentleman, in his 80’s, who was living in one of the units He wanted to sell because he was no longer willing or able to keep the property up. But he still needed a place to live, so he added one condition to the deal. He would sell the property at the price we offered so long as he was able to stay in the property at a reduced rent rate for as long as he lives. We gladly agreed to his terms.

Less than a month after we closed on the property we had the two empty units renovated and rented. It now brings in $1300 a month in income. This property has relatively low expenses, partially because it is outside the city limits and only has county property taxes. Additional expenses include insurance, lawn care, water utility bill, and miscellaneous repair expenses. These expenses total around $300 per month, making the net profit about $1000 per month. Since we are 50/50 partners I am entitled to half the profits, of which my share would be $500 per month. This more than pays for my truck payment which is only $437.57. I will actually still make more on this deal because of the fact that I can write off my business mileage on my taxes.

Here are the Numbers in the Deal:

My Business Partner and I Invested $50000 ($25000 each)

Triplex Purchase Price $43000

Repairs to Triplex $6000

Total Investment $49000

Expenses:

Annual Liability Insurance $127 ($10.58 per Month)

Water Bill $25

Lawn Care $80 per Month (9 Months)

Annual Property Taxes $310 ($25.83 per Month)

Total Monthly Expenses $141.41

Income:

Monthly Rental Income $1300.00

Less Utilities, Taxes, Insurance -$ 141.41

Less Miscellaneous Expenses -$ 158.59

Net Monthly Profit on Triplex = $1000.00

My Half of Monthly Profit $500

Monthly Return $500/25000=2% (24%APR)

Truck Loan 4.24% APR

Payment $437.57 @75 months paying $500mo pays off in a little over 5yrs